Electronic payment processing is a term used to describe the process of transferring money from one party to another for goods, services, or donations. The electronic payment processing system allows businesses and consumers to securely pay for goods and services using credit cards, debit cards, or other forms of digital payment. One of the most popular payment processing systems is BlueSnap .

What is BlueSnap?

BlueSnap is a global payment gateway that processes payments for merchants through its secure connections with leading card networks, banks, and merchant acquirers. Furthermore, BlueSnap offers innovative features that make it stand out from other payment gateways. These features include adaptive payment processing, which can detect the best network route for each transaction; robust fraud protection tools; and automated billing and reconciliation.

Advantages of Using BlueSnap as Your Payment Processor

There are many advantages to using BlueSnap for payment processing. For starters, the system is incredibly fast and reliable, reducing the chances of payment errors or delays. Additionally, BlueSnap provides top-notch security for transactions, ensuring that customers’ financial information is safe and secure. Finally, BlueSnap is user-friendly and has simple integration capabilities, making it easy to set up and use.

In addition to these advantages, BlueSnap also offers several specific features that make it an attractive payment processor. BlueSnap’s API allows developers to quickly integrate the platform into their store. It also includes a built-in invoicing system, so merchants can easily manage customer subscriptions and chargebacks. And finally, BlueSnap offers multiple currency options and seamless international payment processing.

Disadvantages of BlueSnap Payment Processing

While BlueSnap is generally a reliable payment processor, there are some drawbacks that merchants should be aware of. For instance, the platform does not offer any kind of loyalty program or rewards system. Additionally, while the website and interface are generally easy to use, they can be slow and unresponsive at times. Finally, BlueSnap’s fees can be quite high, ranging from 3.9% plus 30 cents per transaction.

Overall, BlueSnap is a reliable and secure payment processor that offers several useful features. However, merchants should weigh the advantages against the potential disadvantages before deciding to use this particular processor.

Conclusion: Is BlueSnap the Right Payment Processor for You?

At the end of the day, choosing a payment processor such as BlueSnap boils down to a matter of preference and business needs. Overall, BlueSnap is a reliable processor that offers a variety of features and good security. However, it does have a few drawbacks that you should consider before committing to it as your primary payment processor.

Electronic Payment Processing is a method of transferring money electronically. This type of transaction involves the transfer and receipt of money from one account to another, either through a machine or online. It’s very popular and widely used around the world, as it offers increased security and convenience compared to traditional payments. The process is fast and easy, and allows customers to pay for goods and services quickly and securely, eliminating the need to carry cash in most cases.

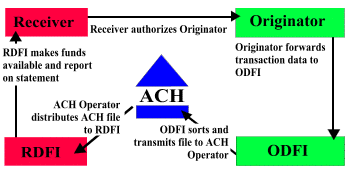

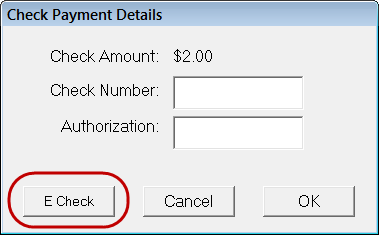

The most common types of Electronic Payment Processing are credit and debit cards, direct deposit, ACH payments, and electronic check processing. It’s also important to note that electronic payment processing also involves two processes that are popular for businesses: merchant services and credit card processing. Merchant services involve the process of capturing, authorizing, and settling payments for customers; and credit card processing involves providing authorization codes for customers and applying their payments to their account. Both processes are crucial for businesses that accept credit and debit cards.